Sukanya Samriddhi Yojana (SSY) Scheme: A Comprehensive Guide with Calculations

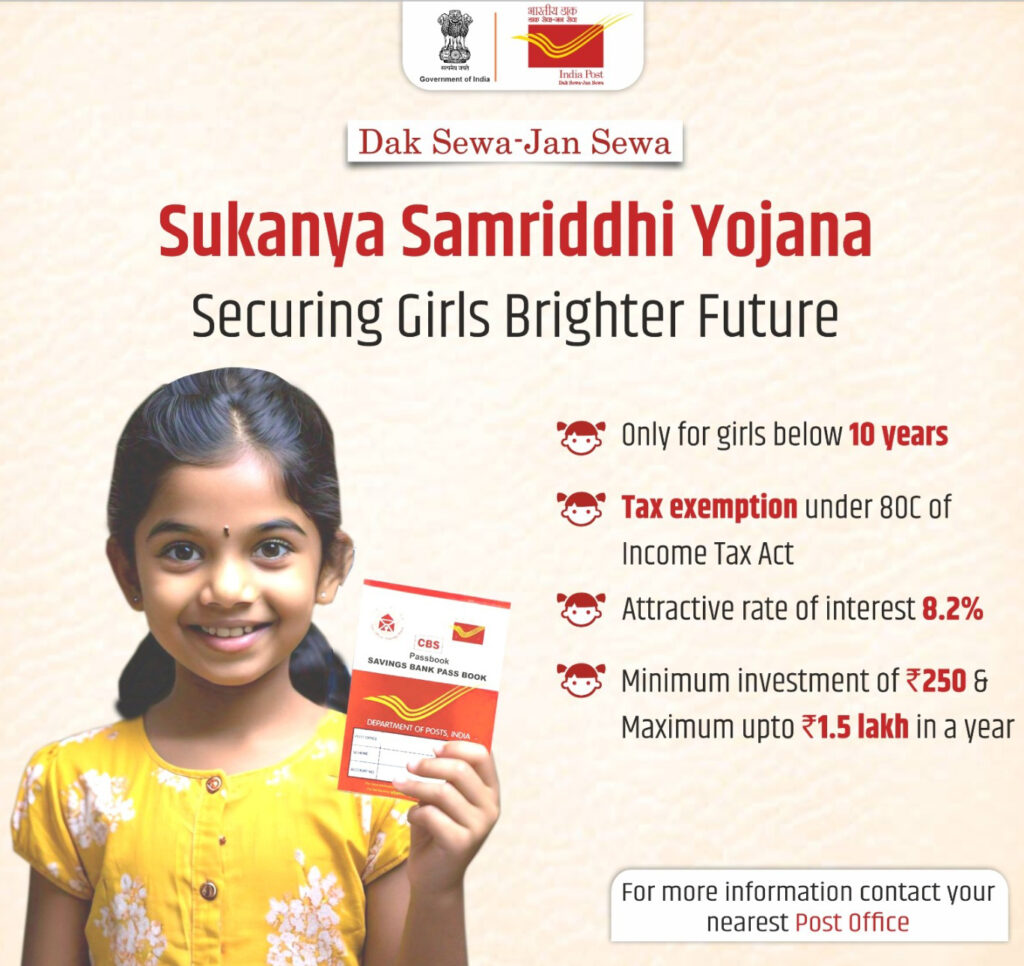

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme launched by the Government of India in 2015 as part of the “Beti Bachao, Beti Padhao” campaign. The scheme is designed to encourage parents to save for the future education and marriage expenses of their girl child. It offers attractive interest rates and tax benefits, making it one of the most popular small savings schemes in India.

Eligibility Criteria

- Account Holder: The account can be opened by the parent or legal guardian of a girl child.

- Age Limit: The girl child must be below 10 years of age at the time of account opening.

- Number of Accounts: Only one account can be opened per girl child, and a maximum of two accounts can be opened per family (for two girl children). In the case of twins or triplets, more than two accounts can be opened.

Key Features of Sukanya Samriddhi Yojana (SSY)

- Eligibility:

- The account can be opened for a girl child below 10 years of age.

- Only one account per girl child is allowed.

- A maximum of two accounts per family is permitted unless twins or triplets are born.

- Deposit Details:

- Minimum deposit: ₹250 per year

- Maximum deposit: ₹1.5 lakh per year

- Deposits can be made until the completion of 15 years from the date of account opening.

- Interest Rate:

- The SSY interest rate is revised quarterly. As of the latest update, the interest rate is 8.2% per annum (compounded annually).

- Maturity Period:

- The scheme matures after 21 years from the date of account opening.

- Partial withdrawal of up to 50% is allowed for the girl’s higher education after she turns 18.

- Tax Benefits:

- SSY falls under Exempt-Exempt-Exempt (EEE) category, meaning:

- Deposits are eligible for deduction under Section 80C of the Income Tax Act.

- The interest earned is tax-free.

- The maturity amount is also tax-free.

- SSY falls under Exempt-Exempt-Exempt (EEE) category, meaning:

Step-by-Step Guide to Open an SSY Account

- Visit a Bank or Post Office

- The SSY account can be opened at an authorized bank or a post office.

- Note : SSY accounts can be opened at any post office or authorized banks (such as SBI, HDFC, ICICI, etc.).

- Fill the SSY Account Application Form

- Provide details such as the girl child’s name, guardian’s details, address proof, and birth certificate of the child.

- Deposit the Initial Amount

- A minimum of ₹250 is required to start the account.

- Submit Required Documents

- Birth Certificate of the girl child

- ID and Address Proof of the guardian

- Photographs of the child and guardian

- Receive the Passbook

- A passbook is issued containing all account details, transactions, and interest updates.

Sukanya Samriddhi Yojana Calculation

Example: If You Deposit ₹1.5 Lakh Annually

Assuming you deposit ₹1,50,000 per year for 15 years at 8.2% interest, the maturity amount after 21 years would be calculated as follows:

Step 1: Total Investment

Years of Contribution = 15 years

Annual Deposit = ₹1,50,000

Total Deposit = 15 × 1,50,000 = ₹22,50,000

Step 2: Interest Calculation (Compounded Annually at 8.2%)

After 15 years, interest will continue to accrue for the remaining 6 years without further deposits.

Using the compound interest formula:

A = P × (1 + r/n)^(nt)

Where:

- A = Maturity amount

- P = Principal (Total Investment)

- r = Annual interest rate (8.2% or 0.082)

- n = Number of times interest applied per time period (1 for annual compounding)

- t = Number of years

For the first 15 years:

- Amount after 15 years = ₹1,50,000 × [(1.082^15 – 1) / 0.082] × (1 + 0.082)

- Approximate value = ₹43,98,639

For the next 6 years (interest-only accumulation):

- Final maturity amount = ₹43,98,639 × (1.082^6)

- Approximate value = ₹75,00,000

Step 3: Total Maturity Amount

- Invested Amount: ₹22,50,000

- Interest Earned: ₹52,50,000

- Total Maturity Amount: ₹75,00,000 (approx.)

Partial Withdrawal Calculation ( Rules)

If you withdraw 50% of the balance at 18 years of age, calculations will change slightly:

- If the balance at 18 years is ₹30 lakh, you can withdraw up to ₹15 lakh for higher education.

- The remaining amount will continue to earn interest until 21 years.

- Closure: The account can be closed after the girl child turns 18, provided the purpose is for her marriage. However, the account must have been active for at least 5 years.

Tax Benefits

- Deposits: Eligible for deduction under Section 80C (up to ₹1.5 lakh per annum).

- Interest: Tax-free under Section 10(11A).

- Maturity Amount: Fully exempt from tax.

Benefits of Sukanya Samriddhi Yojana

- High-interest rate compared to regular savings accounts and FDs.

- Long-term financial security for the girl child.

- Full tax exemption under Section 80C.

- Guaranteed returns as it is a government-backed scheme.

- Ideal for education and marriage planning.

Disadvantages of SSY

- Long Lock-In Period: The account matures after 21 years, which may not suit everyone.

- Limited Flexibility: Withdrawals are restricted and can only be made for specific purposes.

- Age Limit: The girl child must be below 10 years at the time of account opening.

Conclusion

Sukanya Samriddhi Yojana is one of the best savings plans for securing a girl child’s financial future. With a high-interest rate and tax-free benefits, it is a great investment option for parents looking to build a substantial corpus over time. By making disciplined investments, parents can ensure their daughter’s education and other financial needs are well taken care of.

Final Note: The calculations provided are based on the current interest rate . Interest rates may change in the future, so it’s advisable to check the latest rates before making any financial decisions.

Pro Tip: Start investing early to maximize the power of compounding and secure a brighter future for your child.